Are you an entrepreneur or investor looking to expand your business ventures into Europe? Bulgaria has emerged as a highly sought-after destination, offering a unique blend of strategic location, growing economy, and favorable tax policies.

With its low corporate tax rates and easy access to European markets, Bulgaria presents an attractive opportunity for those seeking to establish a European business presence. The country’s skilled labor force and competitive costs make it an ideal location for businesses looking to thrive.

As we explore the process of setting up a company in Bulgaria, you’ll discover why this Balkan country has become a hub for savvy investors and entrepreneurs. Let’s delve into the benefits and requirements of starting a business in this promising European state.

Table of Contents:

- Why Bulgaria Is an Attractive Business Destination

- Types of Business Entities in Bulgaria

- Step-by-Step Company Formation Bulgaria Process

- Documentation and Legal Requirements

- Tax Benefits and Financial Considerations

- Post-Registration Obligations and Compliance

- Conclusion: Maximizing Your Business Potential in Bulgaria

Why Bulgaria Is an Attractive Business Destination

Located at the crossroads of Europe, Bulgaria offers a compelling proposition for companies seeking to establish a strong presence in the region. Its unique blend of strategic advantages makes it an enticing destination for investors.

Strategic Location and EU Membership

Bulgaria’s membership in the European Union provides businesses with access to a vast and integrated market. Its strategic location allows for easy access to major European markets, facilitating trade and commerce.

Economic Stability and Growth Potential

Bulgaria has demonstrated economic stability and growth potential, making it an attractive destination for businesses. The country has experienced steady economic growth, driven by a favorable business environment and investment-friendly policies.

Low Cost of Living and Business Operations

The costs associated with living and doing business in Bulgaria are significantly lower compared to Western European countries. Some of the key advantages include:

- Substantially lower operating costs, with competitive rates for office space, utilities, and services.

- A flat 10% corporate tax rate, one of the lowest in the EU, reducing the tax burden for businesses.

- Highly competitive labor costs, with skilled professionals available at salary levels 3-5 times lower than in Western Europe.

Bulgaria provides excellent value in terms of quality-to-cost ratio across various business expenses. These cost advantages enable businesses to allocate resources more efficiently, potentially increasing profitability while maintaining high-quality operations.

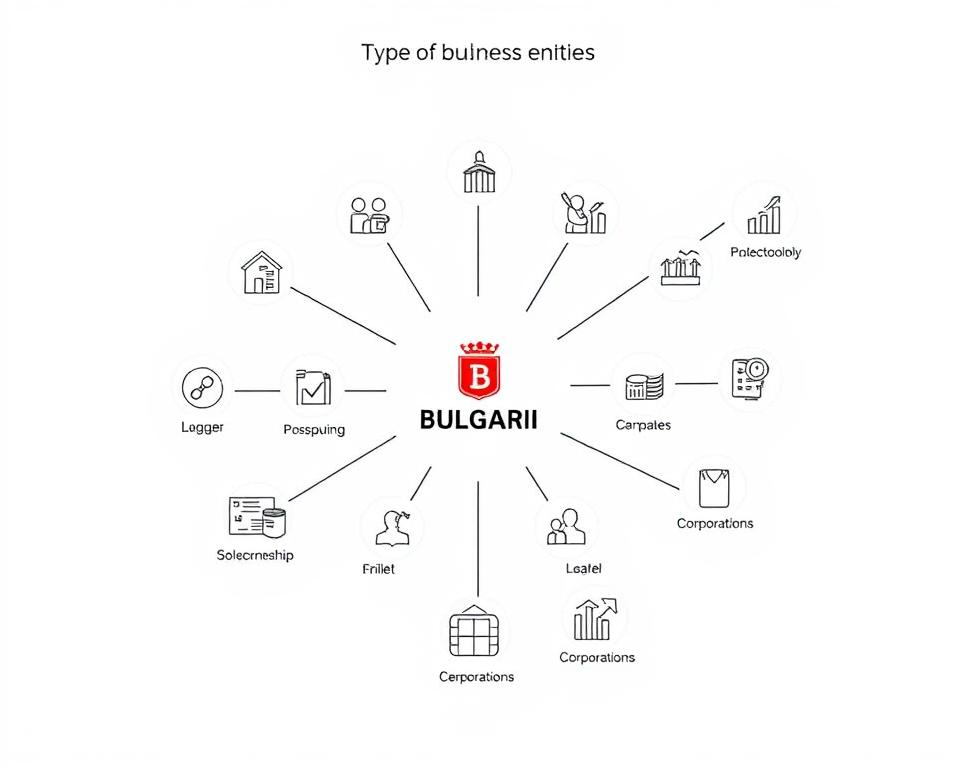

Types of Business Entities in Bulgaria

Companies seeking to enter the Bulgarian market have multiple options for establishing a legal entity. The choice of business entity depends on various factors, including the size of the investment, the nature of the business activities, and the level of control desired by the foreign parent company.

Limited Liability Company (OOD/EOOD)

A Limited Liability Company (OOD/EOOD) is one of the most common types of business entities in Bulgaria. It offers flexibility in terms of ownership structure and management. To establish an OOD/EOOD, a minimum of one shareholder is required, and the minimum capital requirement is relatively low, making it an attractive option for foreign investors.

The registration process involves preparing the Articles of Association, obtaining a unique company name, and registering with the Commercial Register. An OOD/EOOD is considered a separate legal entity, providing its owners with limited liability protection.

Joint Stock Company (AD)

A Joint Stock Company (AD) is another form of business entity that can be established in Bulgaria. It is suitable for larger businesses or those planning to raise capital through public share offerings. The establishment of an AD requires a minimum of one shareholder and a higher minimum capital requirement compared to an OOD/EOOD.

The registration process for an AD involves more complex formalities, including the preparation of Articles of Association and registration with the Commercial Register.

Branch Offices and Trade Representative Offices

For foreign companies not wishing to establish a separate legal entity in Bulgaria, setting up a Branch Office or a Trade Representative Office (TRO) is an alternative. A Branch Office operates as an extension of the parent company and is registered with the Commercial Register.

While a Branch Office is not a separate legal entity, it has a certain level of autonomy and can conduct business activities in Bulgaria. From a tax perspective, Branch Offices are considered “permanent establishments” and are subject to corporate income tax.

- Branch offices provide foreign companies a way to establish a presence in Bulgaria without creating a separate legal entity, operating as an extension of the parent company.

- While branches must register with the Commercial Register, they don’t require separate articles of association or minimum capital requirements, simplifying the establishment process.

- From a tax perspective, branches are considered “permanent establishments” and trigger corporate income tax liability in Bulgaria for the foreign parent company at the standard 10% rate.

- Trade Representative Offices (TROs) offer a more limited presence, allowing foreign companies to conduct non-commercial activities like market research, promotions, and establishing business contacts.

- TROs register with the Bulgarian Chamber of Commerce and Industry rather than the Commercial Register and generally don’t conduct business activities that would trigger tax obligations in Bulgaria.

Step-by-Step Company Formation Bulgaria Process

To successfully register a company in Bulgaria, it’s essential to understand the step-by-step process involved. This process is designed to be efficient and transparent, ensuring that your business can start operating quickly.

Choosing and Verifying a Company Name

The first step in the company formation process is choosing a unique name for your company. The name must be verified to ensure it doesn’t already exist in the Bulgarian Commercial Register. This step is crucial as it will be the identity of your business in Bulgaria.

Preparing Articles of Association

The Articles of Association is a critical document that outlines the company’s structure, management, and operational rules. It must be prepared in accordance with Bulgarian law and signed by the founders. This document is required for registration with the Commercial Register.

Opening a Corporate Bank Account

To operate a company in Bulgaria, you need to open a corporate bank account. This account will be used for all company transactions, and it’s where you’ll deposit the initial capital. The bank may require the Articles of Association and identification documents from the founders.

Registration with the Commercial Register

Registration with the Commercial Register is a mandatory step for all companies in Bulgaria. The registration process involves submitting the required documents, including the Articles of Association, and paying the registration fee. Once registered, your company will receive a unique identification number.

Beneficial Owner Registration Requirements

Bulgaria’s anti-money laundering regulations require all newly formed companies to identify and register their ultimate beneficial owners (UBOs). A beneficial owner is any natural person who ultimately owns or controls the legal entity through direct or indirect ownership of at least 25% of the shares or voting rights. Companies must keep this information up to date, notifying the Register of any changes within 7 days.

The registration of beneficial owners is a critical compliance step, and failure to do so can result in significant penalties. Ensuring that your company’s beneficial owners are registered correctly is essential for avoiding these issues.

Documentation and Legal Requirements

To successfully register a company in Bulgaria, it’s essential to be aware of the necessary documentation and legal prerequisites. The process involves several key steps and requirements that must be fulfilled to ensure compliance with Bulgarian law.

Required Documents for Company Registration

The registration process requires several essential documents, including the Articles of Association, identification documents for the company’s founders and directors, and proof of address. Ensuring that these documents are accurately prepared is crucial for a smooth registration process.

- Articles of Association

- Identification documents for founders and directors

- Proof of address

- Other relevant documents as required by the specific company type

Notarization and Legalization Procedures

Certain documents may need to be notarized or legalized, depending on their origin and the requirements of Bulgarian law. Notarization involves verifying the authenticity of a document’s signature, while legalization (or apostille) is a process that authenticates the document for use in foreign countries.

Minimum Capital Requirements

Bulgaria offers some of the lowest minimum capital requirements in the EU, making it an attractive destination for entrepreneurs. For a Limited Liability Company (OOD/EOOD), the minimum required capital is just 2 BGN (approximately €1), with each share having a minimum value of 1 BGN. In contrast, Joint Stock Companies (AD) require a more substantial minimum capital of 50,000 BGN (approximately €25,000).

The capital must be deposited into a corporate bank account before registration and remains blocked until the company is officially registered with the Commercial Register. While the minimum capital requirements are low, especially for OOD/EOODs, entrepreneurs should consider their actual business needs when determining appropriate capitalization levels.

Tax Benefits and Financial Considerations

Bulgaria offers a highly competitive tax environment that can significantly benefit businesses looking to expand or establish themselves in Europe. This competitiveness is primarily driven by its corporate income tax structure, VAT regulations, dividend taxation policies, and social security contributions.

Corporate Income Tax Structure

Bulgaria boasts one of the lowest corporate income tax rates in Europe, making it an attractive destination for businesses. The corporate tax rate is applied uniformly to both resident and non-resident companies, simplifying tax compliance.

VAT Registration and Compliance

Value-Added Tax (VAT) registration is mandatory for businesses with an annual turnover exceeding a certain threshold. Bulgaria’s VAT system is aligned with EU directives, ensuring compliance and facilitating trade within the European Union.

Dividend Taxation and Profit Repatriation

Bulgaria has a favorable regime for dividend taxation, allowing for the repatriation of profits with minimal tax implications. This encourages foreign investment by ensuring that profits can be easily returned to investors.

Social Security and Labor Costs

Bulgaria’s social security contributions, while higher than its corporate tax rate, remain competitive compared to other European countries. Employers contribute approximately 60% of social security costs, with employees covering the remaining 40%. Total employer contributions range from 18.5% to 19.6% of gross salary, making Bulgaria an appealing location for labor-intensive businesses due to its competitive labor costs and skilled workforce.

Post-Registration Obligations and Compliance

After successfully registering a company in Bulgaria, businesses must comply with various post-registration obligations to maintain their legal status. This includes several key areas that require ongoing attention to ensure continued compliance with Bulgarian regulations.

VAT and Fiscal Device Registration

Companies in Bulgaria that are required to charge VAT must register for a VAT number and comply with VAT regulations. This includes using fiscal devices that are certified by the Bulgarian authorities. Proper VAT registration is crucial for avoiding penalties and ensuring smooth operations.

Employee Registration with National Revenue Agency

Employers in Bulgaria are required to register their employees with the National Revenue Agency. This involves submitting necessary documentation to ensure compliance with labor laws and social security regulations. Timely registration of employees is essential for avoiding fines and penalties.

Annual Financial Reporting Requirements

Bulgarian companies are required to prepare and submit annual financial reports. These reports must be prepared in accordance with Bulgarian accounting standards and submitted to the relevant authorities. Accurate accounting and timely reporting are critical for maintaining compliance.

Working Hours Registration with Local Authorities

In Bulgaria, companies are required to register the working hours of their commercial sites with the local mayor. This involves submitting various documents, including an opinion from the regional health inspectorate, and any other requirements specified by the mayor. Businesses must update this registration whenever their operating schedule changes.

To comply with working hours registration, businesses must submit an application to the local mayor’s office along with supporting documentation. For businesses in sectors like food service or retail, additional permits may be required. This regulatory framework is aimed at consumer protection and ensuring proper business operations.

Conclusion: Maximizing Your Business Potential in Bulgaria

Bulgaria offers a unique blend of strategic location, competitive tax environment, and skilled workforce, making it an attractive destination for entrepreneurs. By setting up a company in Bulgaria, businesses can leverage its EU membership and favorable business climate to expand into the European market.

The country’s business-friendly environment, characterized by low operational costs and a straightforward company formation process, makes it an ideal location for startups and established businesses alike. To maximize your business potential in Bulgaria, it’s crucial to work with local professionals who understand the nuances of Bulgarian business law and accounting requirements.

By maintaining proper compliance with ongoing obligations, businesses can ensure long-term success and profitability in the European market. Whether you’re establishing a small startup or creating a regional headquarters, Bulgaria’s business services provide a solid foundation for growth.